- The new timeline for BEAD will have everyone turning in their Final Proposals at the same time

- Then, they'll have to compete against each other for the labor force to deploy their broadband projects

- But it looks like there will be plenty of supply of made-in-America products

MOUNTAIN CONNECT, DENVER — It seems the 90-day timeline the current administration allocated for states to resubmit their Broadband Equity, Access and Deployment (BEAD) program proposals has folks in the industry stressed. One thing that came up a lot at the Mountain Connect show yesterday was that the new rules for BEAD program have put everyone on a very tight (and simultaneous) timeline.

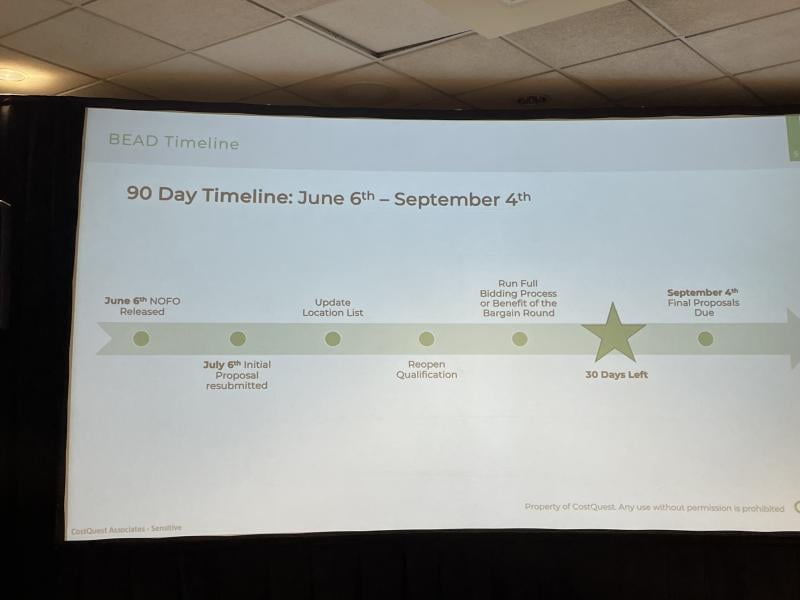

The new BEAD notice of funding opportunity (NOFO) was released on June 6 and state broadband offices have been scrambling to re-do their bidding processes and prepare the second versions of their Final Proposals – all before September 4.

They’ve had to update their BEAD eligible location lists and reopen their pre-qualification processes for applicants under the new round of bidding that’s referred to as the “Benefit of the Bargain” round.

Then, beginning on September 4, the National Telecommunications and Information Administration (NTIA) will have to work the midnight hours to review everything, meet with representatives of each of the 50 states and six territories, and get BEAD disbursements out the door by the end of the year as promised by Commerce Secretary Howard Lutnick.

Whew!

Prior to all the changes from the Trump Administration, the process had been staggered with some states, such as Louisiana, ready to put shovels in the ground in January, and other states in various stages of readiness.

Consultant Carol Mattey, who moderated a panel at Mountain Connect said, “Everything is jammed into this one date in September rather than a rolling timeline, funneling all the decisions into a single moment in time.”

Josh Etheridge, chief strategy officer with the broadband construction company EPC in Louisiana, said his company had been developing a pipeline of workers for BEAD, spending “hundreds of thousands of dollars” to gear up the necessary workforce. He added “It was a humungous hit in the gut” when the Trump administration made all the states restart their timelines in June. He also noted that with everyone now being on the same timeline, that will exacerbate the labor shortage to deploy the new telecommunications infrastructure.

“Everybody will be competing for these same contractors at the same time. We’re big-time short on the workforce we’re going to need to deploy this across the U.S.,” said Etheridge.

Where does BABA fit in all this?

Nokia’s VP of Broadband Policy & Funding Strategy Lori Adams talked a bit about the Build America Buy America (BABA) program set up under the Biden administration, which requires BEAD winners to use equipment made in the U.S. The BABA program incited several companies to on-shore manufacturing facilities, including Nokia, Vecima, Infinera, Ciena and Adtran. Last October, the NTIA issued the first self-certification list for companies that are BABA-compliant.

Adams said, “Under the Biden administration the vast majority of awards were expected to be for fiber. Forty-five companies self-certified at 72 individual manufacturing locations. That is a tremendous response to a requirement. All of these 72 locations are now looking for orders.” It remains to be seen whether the administration's decision to shift away from BEAD's fiber preference will impact volumes.

Fortunately, there are, however, other areas of the fiber industry that are creating demand for fiber, such as the demand that’s being created by AI and data centers.

And Etheridge noted that a lot of fiber builds are being done by private equity outside of any concern about BEAD. “The orders are starting to pick up considerably,” he concluded.